AI for insurance agencies: A no-hype practical guide

The reality cuts through the noise—AI won't replace agents, but agents who understand AI will replace those who don't.

The Adoption Paradox

Independent agencies face a critical gap. While carriers are racing ahead with billion-dollar investments, most agencies are still on the sidelines. This gap represents both your biggest competitive risk—and your biggest opportunity to differentiate.

"AI will not replace human agents, but AI tools have the potential to save agents time... by streamlining routine administrative tasks."— Agent for the Future (Liberty Mutual/Safeco)

The Reality: AI excels at defined tasks (documents, email) but fails at relationship judgment.

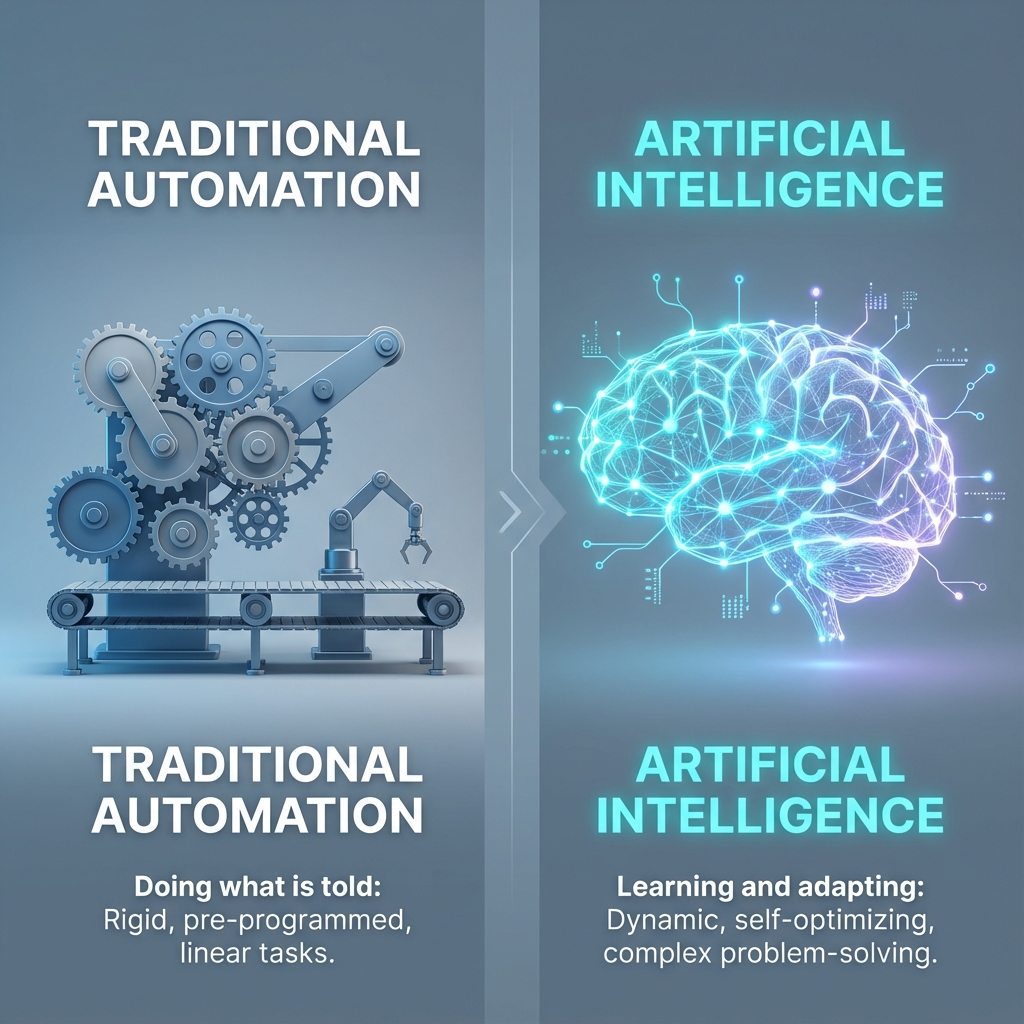

What AI Actually Is (And What It Isn't)

The industry conflates three distinct technologies. Don't let vendors confuse you.

1. Traditional Automation

"Doing what is told." Rigid if-then rules. When a renewal date hits, send an email. No learning, no adaptation. This is your AMS workflow to-do list.

2. Artificial Intelligence (ML)

"Learning and adapting." Systems that analyze historical data to predict future outcomes. Example: "Clients with X characteristic are 40% more likely to lapse."

3. Generative AI (LLMs)

"The Guessing Machine." ChatGPT, Claude, Gemini. They excel at drafting text and summarizing, but because they are probabilistic, they can "hallucinate" (make up facts). Great for drafts, dangerous for final decisions. (See our guide on maintaining brand voice).

Proven Workflows & Interactive ROI

Document Processing

Automated extraction from ACORD forms, loss runs, and dec pages. Human review is still needed, but the heavy lifting is gone.

- • Roots AI: 98% accuracy on ACORD forms

- • Archipelago: 75-90% time reduction on SOV/loss runs

Policy Servicing

Certificate issuance and FAQ chatbots. Resolving routine inquiries without producer intervention.

- • Certificate Hero: 90% reduction in mailed certs

- • Zurich's "Zuri": 50% of inquiries resolved without calls

Retention Analytics

Predictive models identifying at-risk accounts before the renewal notice generates.

- • J.D. Power: 23% improvement in retention rates

- • EZLynx Retention Center: Identify price-increase churn risk

Lead Qualification

AI scoring and routing to the right producer based on intent signals.

- • 80% faster response times

- • 70% reduction in data gathering time

Risk & Compliance

The NAIC Model Bulletin isn't a suggestion—it's the future of regulation. Half of U.S. states have already adopted it. For a full decision matrix, see our Strategic Evaluation Framework.

E&O Critical Warning

Major carriers (AIG, W.R. Berkley) are adding "Absolute AI Exclusions" to policies. Review your E&O coverage immediately. If an AI error causes a client loss, you are liable.

- Data Privacy: Never enter PII into free tools. You are training their model with your client data.

- Human Oversight: California SB 794 proposes requiring human sign-off for adverse decisions.

Your Week 1 Experiments (Zero Risk)

Email Drafting (See 5 Prompts)

- Use ChatGPT Free

- No PII allowed

Doc Summaries

"Summarize the 3 key underwriting changes for my team meeting."

- Saves 30+ mins reading

- Great for team prep

Meeting Notes

- Auto-extract action items

- 100% accountability

Essential Terminology

Agentic AI

Systems that can take autonomous actions toward goals with minimal human intervention. Expected mainstream by 2026-2028.

Hallucination

When AI generates plausible but false information. A fundamental, inescapable feature of probabilistic LLMs.

NAIC Model Bulletin

Guidance establishing expectations for responsible AI use by insurers; adopted by nearly half of states.

Predictive Analytics

Using historical data patterns to forecast future outcomes like customer churn or claims frequency.

SOC 2 Type II

Security certification demonstrating sustained compliance with trust service criteria. Mandatory for any AI vendor you hire.

"Responsible adoption of AI is key. Speed to adopt should not be at the expense of thoughtful change. It is critical to balance innovation with empathy, governance and, most importantly, trust."

Ready to safely pilot AI?

EffiZoom provides a secure, compliant environment with pre-trained AI agents that understand insurance. No setup required.

Meet Your First AI EmployeeEffiZoom Support

How can we help you today?